As half of Australia's aged care homes continue to operate at a loss, accountants StewartBrown presented "an inescapable fact".

"It is well documented that the residential aged care sector has undergone operating losses for the past four financial years with a further loss likely for FY24. This has had the combined effect of reducing equity in the sector, inhibiting innovation, discouraging investment in existing building stock and new builds, and causing concerns around care delivery.

"StewartBrown and Grant Corderoy as a former member of the Taskforce has spent the last five months since the Report was issued attending and presenting at sector Conferences, providing briefings to providers in each State, meetings and analysis with peak bodies and considerable discussions with the Opposition and some independent members of parliament in relation to the Taskforce recommendations, implications, and consequences. Together with considerable other public comment from the peak bodies, media, and sector stakeholders, it would be fair to suggest that the Taskforce Report has a high level of acceptance. There has, as would be expected, some limited negative commentary, which is beneficial for any reform process, and some of this has been addressed, from our perspective, in the Survey Report.

"We like to acknowledge the considerable and constructive time spent by Minister Butler, Minister Wells (and their offices) and Senator Ruston (and her team) who have been available and very diligent in their consideration of the recommendations and any potential unintended consequences should the reforms be implemented. StewartBrown has been available at all times to provide any modelling or trend analysis as required during this process utilising the aggregate data StewartBrown has available.

"It is our view, based on our considerable discussions, that the Taskforce recommendations will be largely adopted, albeit it with some amendment.

"We believe it highly beneficial for the Government and Opposition (including cross benches) to provide a clear and unambiguous statement of intent as soon as possible to provide some certainty to the sector and stakeholders. Delaying any such statement of intent or overall response from the Government will cause further unease that must be avoided. A major concern is that there is a growing shortage of beds available to meet increased projected occupancy demands due to the lack of new builds over the past years as a result of sustainability concerns, and this directly impacts the hospital bed occupancy and bed blocking."

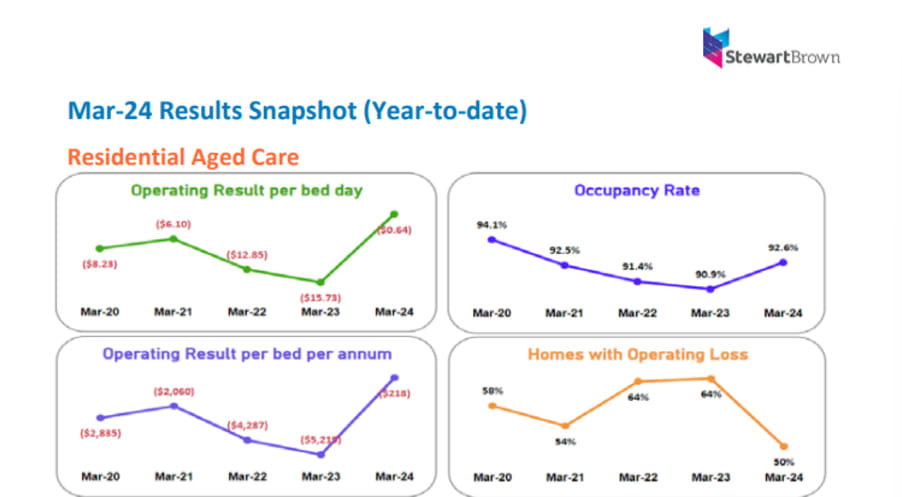

There has been an improvement in the financial performance of aged care operators with losses down to just $0.64 per bed due to increased Government funding for care operations, which is subsidising losses in the delivery of everyday living and accommodation services. However, as higher wage bills kick in to meet compliance with higher care minute targets over the coming months, the higher returns achieved so far this year are likely to be eroded, StewartBrown states.

The YTD direct care result for March 2024 increased by $9.73 per bed day (pbd) to a surplus of $15.13pbd, compared with a $5.41pbd surplus for the previous corresponding period, due to the increase in AN-ACC funding. The indirect care result and accommodation result remained in deficit. The indirect care result improved to a deficit of $5.62pbd (compared with a deficit of $7.50pbd for the previous corresponding period). The accommodation result (including administration) improved to a deficit of $10.16pbd (compared with a deficit of $13.63pbd in the previous corresponding period)

Other highlights from the 54-page report include:

- The aggregate Net Loss Before Tax over the last five years is more than $5 billion.

- Occupancy for the year to date to March 2024 was on average 92.6%, down from the end of 2023 when it was 92.8%, but up from 90.9% as of the previous corresponding period.

- The report looks at economies of scale in residential aged care, finding that operators with 21 or more homes reported on average an operating profit of $8.44 pbd, compared with a loss of $8.72 pbd for operators with between two and six aged care homes.

- Staff shortages mean an additional $3.95 pbd in additional agency costs will be needed on average to reach target RN care minutes, the report estimated.

- The supported resident ratio fell to 45.9%, compared with 46.2% in the previous corresponding period.

- The average RAD for the YTD was $494,823, a 5.4% increase on the $469,679 of the previous corresponding period.

- Agency costs were $18.62 per resident per day for the March 2024 quarter, which was actually a decline from the March 2023 quarter, but 6% increase on the December 2023 quarter.

The report is compiled from data from 1,202 aged care homes, 210 Approved Provider organisations, and 68,266 Home Care Packages.