ASX-listed Aspen buy Gannon family’s Wodonga village: plans to convert it to an LLC

Aspen Group, which is better known for holiday parks, has bought the 172-home Wodonga Gardens Retirement Estate in West Wodonga, on the Victorian side of the border with NSW, for $6.1 million. The village has a long history. As we reported here, in...

Aspen Group, which is better known for holiday parks, has bought the 172-home Wodonga Gardens Retirement Estate in West Wodonga, on the Victorian side of the border with NSW, for $6.1 million. The village has a long history. As we reported here, in its very early stages it was conceived by Ted Sent’s Primelife and in the basket of villages that Lendlease won when it raided Babcock & Brown Communities (who had purchased Primelife). The renamed group, Lend Lease Primelife then sold the village in 2010 to SA’s Tom Gannon and his Gannon Lifestyle Communities. Gannon has largely built out the 172-home Wodonga village over 11 years. In 2009, Gannon also purchased its Griffith (NSW) village from Lend Lease Primelife. The Gannon family was a pioneer in the village sector; they sold their nine villages for $85 million to AMP Capital Meridien in 2007, led by Tim Russell, perfectly timed just before the GFC. Those nine villages became a cornerstone of what is now RetireAustralia.

Aspen likes land lease model

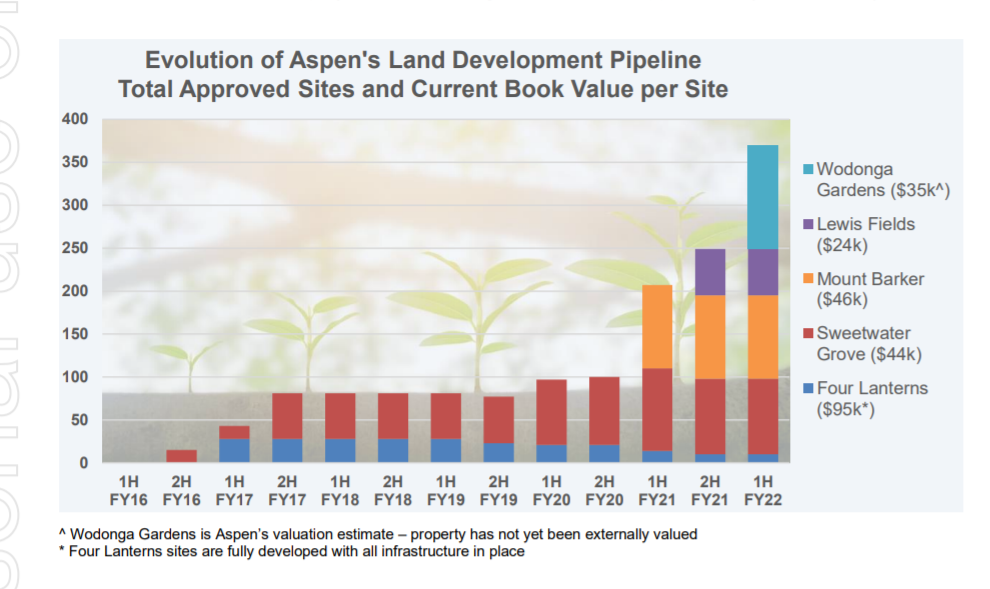

The Sydney-based company expects settlement in August. Aspen intends turning future houses into a land lease community. This will add to the 172 homes built and leased on the 8.8ha of land. Aspen’s retirement assets will increase to seven across four states and its land development pipeline will expand by 49% to 370 approved sites after the purchase. The Wodonga homes are covered by a conventional loan/lease arrangement for retirement villages with a total exit charge of up to 36%. Recent sales of the houses have been priced around $300,000 on average, equating to average total exit fees of $108,000 per house, said Aspen Group.

“We are considering developing and selling future houses under a land lease community model (LLC) as we believe the product is more appealing to customers,” the company said. “For the existing village residents, we could reduce total exit fees to around 25% which, upon re-leasing, should make the houses more appealing to incoming residents and result in outgoing residents receiving higher proceeds.”

Aspen expects to develop and sell at least 10 houses per year, with holding deposits for eight new homes. The interesting side note is that the Gannon family has also entered the land lease market, with two LLCs in Moonta Bay and Ballarat.