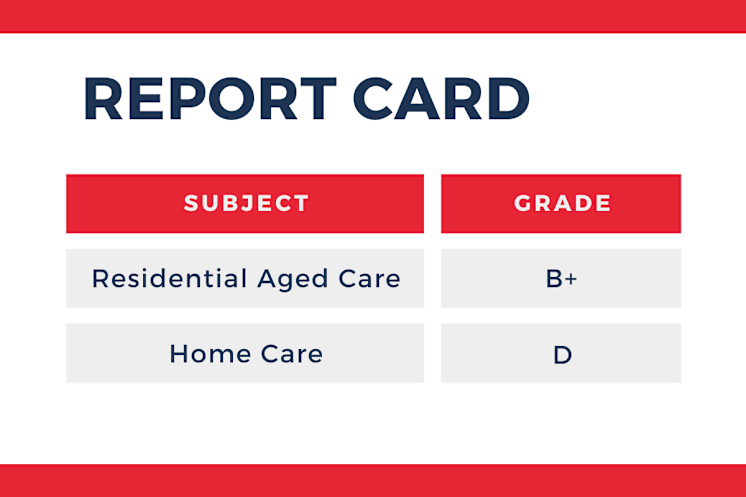

The final report card for the aged care sector looks very different depending on what services you deliver.

Residential aged care – B+

After years of regulatory and financial uncertainty, the residential aged care sector is finally on a stable financial footing – a big plus.

Providers have been thrown though by today’s Mid-Year Economic Fiscal Outlook (MYEFO) 2024-25 which revealed that residential aged care will move to the same payment in arrears model as home care and the NDIS from 1 July 2026, which could impact on cash flow.

But the real devil is in the circa $600,000 cost to build a new aged care bed.

With the competition with the residential sector for premium sites too intense, only large operators have the cash and the land available to build at the current rate of returns.

However, as the over-80 population continues to climb (pictured below), those operators with newer beds will be full and able to run more efficiently with higher occupancy.

With strong demand, these operators will also be able to charge higher prices under the Government’s aged care reforms.

In short, even shared rooms could prove to be ‘rolled gold’.

Home care – D

On the other hand, home care has ended 2024 with a clear ‘‘failure’’.

The latest data from StewartBrown indicates that the average Home Care Package now delivers just 5.22 hours of direct care a week.

The Government is also holding firm on its 10% care management cap under Support at Home despite the Department of Health and Aged Care's latest financial snapshot showing operators’ care management fees for all Home Care Packages are 17% per Package.

How can operators deliver on duty of care on so few hours? And how can they stay viable when the Government will only fund services to a point?

The changes coming for the sector from 1 July 2025 appear unlikely to help.

The Government has pledged 83,000 new Home Care Packages from 2025-26 – where will this workforce come from? We understand it is almost impossible to access home care workers on Sydney’s Northern Beaches because there are no local staff.

Increased consumer contributions for home care also won’t provide the funding boost that operators had expected. As we have discussed, the introduction of higher ‘user pays’ for lower-level services will likely see a consumer shift towards using their Package for higher-level services such as clinical care.

This will hurt the 80% of operators, mostly smaller businesses, which focus on services such as cleaning and domestic assistance.

Will the Aged and Community Care Providers Association, now Ageing Australia, be standing up for these operators?

Watch this space – and if you are interested in hearing more about how other operators are preparing their businesses for this new world, register for our 2025 LEADERS SUMMIT, 18-19 March in Sydney.

We will have executives from Amplar Health, Australian Unity, Silverchain and more discussing their visions and strategies for the future so don’t miss out. Find out more here.