The ASX-listed provider revealed the $1.04 per share offer by Calvary Health Care to the market early on Friday morning.

Formerly known as Little Company of Mary Health Care, the Catholic Not For Profit is one of Australia’s largest healthcare and aged care providers with four public hospitals, 11 private hospitals, 14 aged care facilities and 11 retirement villages plus 12,000 staff.

Calvary does not hold a beneficial or economic interest in Japara, but has thrown its hat into the ring for the company – which, like its fellow listed operators Regis and Estia, has seen its share price dip to record lows during the coronavirus pandemic.

The unsolicited offer would see Calvary acquire 100% of Japara’s shares via a scheme of arrangement.

In return, Calvary would offer Japara’s shareholders an indicative cash price of $1.04 per share.

Japara currently has a market capitalisation rate of $213.79 million – but the surprise offer values the company at $277.8 million.

Japara currently has a market capitalisation rate of $213.79 million – but the surprise offer values the company at $277.8 million.

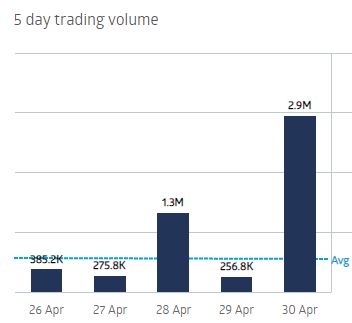

The move came as a surprise to the market – but they liked what they heard.

Japara’s shares jumped 23% from their Thursday close price of $0.80 to trade at $0.98 per share.

Japara says it will now weigh up the proposal, which comes just 11 days before the Federal Budget and an expected increase in funding for the aged care sector.

“The Japara Board has not yet formed a view on the merits of the Indicative Proposal and is currently considering it in the context of, amongst other things, expected improvements in trading conditions and the Federal Government’s upcoming budget and regulatory response to the Royal Commission into Aged Care Quality and Safety recommendations expected in May 2021,” they said in a statement.

Japara’s board has hired Macquarie Capital as a financial advisor and Herbert Smith Freehills as legal counsel as it reviews the deal.

More in next Thursday’s SOURCE.