More than $1 billion in RADs expected to be paid out by the sector while occupancy flatlines – how many providers will be left insolvent?

Earlier this week, we asked the question: where are the sector’s aged care insolvencies? Today, an answer – they are already underway. Advisory firm Ansell Strategic’s submission to the Royal Commission on their financing paper has outlined...

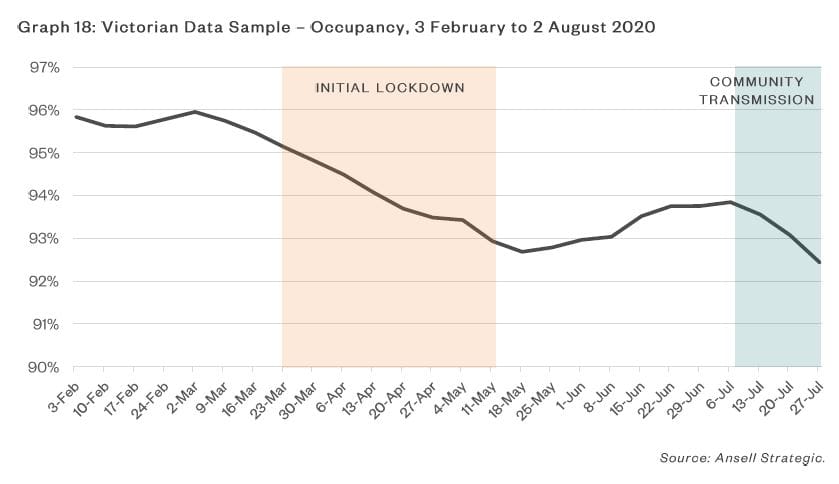

Earlier this week, we asked the question: where are the sector’s aged care insolvencies? Today, an answer – they are already underway. Advisory firm Ansell Strategic’s submission to the Royal Commission on their financing paper has outlined the serious impact of COVID-19 on the sector’s RAD inflows and outflows. Take a look at the graph from the paper above. Ansell has tracked the RADs flows across an approximately 9% sample of the sector over March to July.

RADs going out – but not coming in

While Australia did not have the same level of lockdown and economic disruption as other countries, the number of people electing to pay a RAD has dropped significantly – while RAD outflows have remained the same. Ansell’s submission predicts this will result in an estimated outflow of around $1 billion in cash – but because of delays in probate and payment deferral arrangements, it states the pain of those outflows in March and April will only be felt this month of August. This explains why Ansell’s earlier forecasts in their March ‘Urgent Call to Action’ paper which said insolvencies would begin in May did not eventuate.

Low rates of community infection delayed insolvencies

That report was based on modelling that used data from UK infection rates and projected the rate of community transmission would increase through March, April and May with widespread infection from May to August. But instead cases remained steady from mid-April to mid-June. Australia has only seen heightened levels of infection for the last six weeks.

Surge in cases likely to push providers to the brink

My point? We have not seen that level of insolvencies yet because community transmission did not reach the peaks projected. However, we are seeing those numbers now – and it’s about to get worse. Check out another graph from Ansell’s submission.

As you can see, RAD inflows and outflows have fallen off a cliff as community transmission has increased from June onwards.

High number of cases = a longer recovery

The current surge in community transmission in Victoria is likely to accelerate this process, with Ansell reporting feedback from providers that the new lockdown measures and media coverage were impacting on occupancy as people changed or delayed the decision to enter residential care. The submission adds that most providers were able to recover quickly in May and June because of the low numbers of community cases during the initial lockdown. “Unfortunately, this ‘second wave’ will be different with increased community transmission and providers likely to experience more severe occupancy challenges and a protracted length of recovery,” it states. Government intervention on its way – or not? The question is: will the Government let operators ‘go bust’? As we reported here in February this year, it is not unheard of for the Department of Health to prop up struggling smaller providers until a buyer is found – kicking in over half a million dollars to keep the 40-bed DP Jones aged care home in Murchison in regional Victoria open. The Government has also introduced its $50 million Business Improvement Fund, designed to help providers stay afloat while they improve their business, transfer ownership or shut their doors. But what happens when a larger operator puts up the white flag? Will the Government still be willing to pay to keep the lights on? Will the Government fund billions in RAD outflows over the next 12 months? Is this the perfect storm?