The finance veteran of the Australian retirement village sector is Jim Hazel, and he never misses the opportunity to say that bad things happen; good times do come to an end.

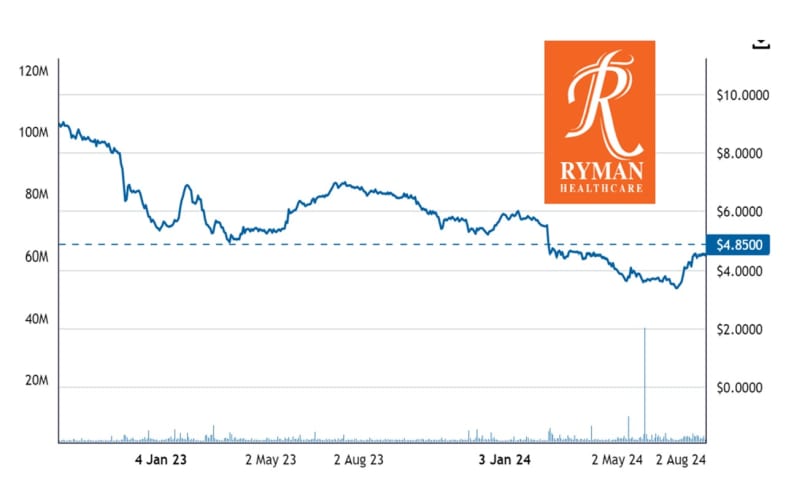

They have come to an end for Ryman Healthcare over the past six weeks.

Ryman has been taking easy decisions for years and they have now come home to roost, and the cost is $1.3 billion in lost shareholder value.

In Dean Hamilton’s Chairman’s Report of 1 August, and the announcements to the NZ Stock Exchange yesterday, this was laid bare.

“Our financial results for the year ended 31 March 2024 were disappointing on a number of fronts. Firstly, on the positive side, we reported an 18% increase in revenue to $689.9 million… However, the combined impact in impairments and one-off costs, some $283.9 million in total, has led to a significant reduction in reported net profit after tax to just $4.8 million, against the $257.8 million we achieved the prior year.”

Sounds plausible but the graph above shows the company has been in decline for a couple of years. Here is part of the reason why.

From its start in 1984, it has stuck with a fast sales formula of a fixed DMF at 20% and fixed weekly fees for life – your cost stays the same year in year out irrespective of inflation or added village costs.

The rest of the NZ sector – and the Australian sector when Ryman appeared here in 2011 – didn’t like this fixed cost because it made everyone else look expensive and perhaps even rapacious.

But as Jim Hazel says, bad things happen. Costs, especially maintenance costs, have taken off, and Ryman is now heavily subsidising the weekly fee of 15,000 residents.

And people are living longer. Ryman’s long-held financial model had seven years as the average residency. But it is now nine years. More fees to subsidise; 30% longer to wait for the DMF rollover.

Ryman also led the philosophy of build and they will come, pushed on by investors that were paying a high P/E ratio and wanting development profits.

They had a target of 15% growth in homes built every year. Recently they had 16 new, big projects in development. This required $3 billion in debt.

To get the sales going, they discounted the first homes. Perhaps this makes sense, but across 16 projects, that is a lot of cash to leave on the table.

Then the trifecta hit. Interest rates went up, costing Ryman massively. Interest rates also hit home buyers, meaning Ryman customers held back. And the construction costs increased by up to 50%.

“The result has been achieved in a particularly challenging operating environment with residential property markets subdued and cost inflation impacting all areas of our business,” says Dean Hamilton.

“We have been unable to fully recycle our build costs with the first sell down of occupation rights across 14 of our last 16 developments.”

This means they have been selling homes at a loss, and this year they will sell between 850 and 950 units and aged care beds.

Some people in New Zealand ask how could Ryman be paying dividends if all the real cash has been going into paying interest? Well Dean Hamilton has cancelled dividends until March 2026 at the earliest.

And he has increased new DMF contracts to 25% and 30%, and cancelled fixed service fees. Ryman is now in the same competitive pool as other Australian operators.

Dean Hamilton is also looking for the Government's Aged Care Taskforce to deliver additional income here in Australia. The interesting thing here is that the strongest advocate for villages sharing in the Taskforce and Government opening up new fees has been Cameron Holland, the Ryman Healthcare Australia CEO, who departed the company yesterday. (We understand he was offered a different role in Ryman but declined).

He has been with Ryman for just over three years but recognised the need to get additional funding, and drafted the ‘Shared Care’ White Paper that has been winning traction in Canberra.

Village operators need to be cautious in the good times. And one can’t help but think there is a lesson here for the land lease sector, which is also locked into a ‘build and they will come’ frenzy. Because bad things do happen.

Side note: for Australians with long memories, Ryman five months ago appointed David Pitman as a non executive director. David was CEO and architect of Stockland’s retirement village strategy to become the dominant player in the village sector. Over six years, from 2007 to 2013, Stockland dominated the big village operators, including forcing the dismantling of the Retirement Village Association and the creation of the Retirement Living Council under the Property Council, which Stockland was the biggest voice. David grew the Stockland village portfolio from 24 to 62 villages but couldn’t grow the return on assets. The objective was 8%; they could only achieve 4%.

Following David at Stockland was Stephen Bull as CEO Retirement. He got ROA up to 6%, on track to 8%, when the ABC Four Corners program went to air in June 2017, and bad things happened.

For Stockland, sales stopped and ROA dropped back to 4%. Stephen moved from Stockland 12 months later. In a delicious irony, he has been an independent director of Ryman’s biggest NZ competitor, Summerset, since February 2022.