Regis delivers stronger than expected HY result on the back of improving occupancy and revenue

The ASX-listed aged care provider has surprised analysts with a better than expected performance in its Half Year results, with its underlying earnings up on the previous corresponding prior to the amortisation of its bed licences. Regis operates 63...

The ASX-listed aged care provider has surprised analysts with a better than expected performance in its Half Year results, with its underlying earnings up on the previous corresponding prior to the amortisation of its bed licences.

Regis operates 63 aged care facilities with 7,000 operational places and over 8,000 staff across all six states and the Northern Territory.

On Monday, it reported a Net Loss After Tax of $25.9 million for the half-year ending 31 December 2022 driven by a $28.5 million amortisation of its operational beds (net of tax) begun in FY21-22.

However, its underlying EBITDA increased to $45.1 million (11% on revenue), up from $44.1 million the same period last year, with the new AN-ACC funding model delivering an uplift of $9.40 to an average $220.70 per resident per day for the second quarter of the financial year.

Regis’ revenue from services also increased 4.4% on the previous corresponding period to $380 million.

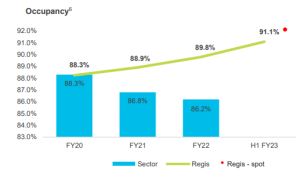

The key driver of revenue – occupancy – was also up 180 basis points improving to 91.1% from 89.3% from the first half of FY22, and spot occupancy sitting at 92.3% as of 24 February 2023.

Managing Director and CEO Dr Linda Mellors noted in her presentation to shareholders that a 1% increase in occupancy equates to $7.5 million in revenue for the company – with the company targeting a 93% occupancy rate by the end of June 2023.

The board also elected to pay a dividend of 2 cents 50% fully franked to shareholders next month.

The positive results were offset by a 5.3% increase in staff expenses (excluding COVID outbreak staff costs) as well as $13 million in COVID-19 outbreak costs – with $32.4 million in claims still to be settled by the Department of Health and Aged Care.

”Overall, the result was comparable with the same time last year which given the operating environment was pleasing,” she told The Weekly SOURCE.

“The additional funding that came through AN-ACC was mostly absorbed through increased costs that came through the staff awards, enterprise agreements, agency fees and other inflation pressures.”

However, Linda says she is optimistic for the future of residential care on the back of this latest set of results, arguing the Government will have to act on the current financial crisis facing the sector.

“We’re on a reform journey now. The Government itself released a report last week showing that 66% of providers are losing money. They can’t ignore that – it’s an essential service.”

See the next story.