This week I received an email from Alok Kumar, CEO of Omega Communities in Adelaide, asking if we had information on retirement village penetration in New Zealand and Australia.

It is a subject worth revisiting for all RV operators.

The New Zealanders keep excellent stats and they gleefully tell us that penetration for all people 75+ has increased from 8% in 2008 to 14% in 2021 on the back of their continuum of care village business model.

In Australia, we historically look to all people 65+ thanks to the ABS and the days when villages were a lifestyle option. And we haven’t analysed the figures in a very long time.

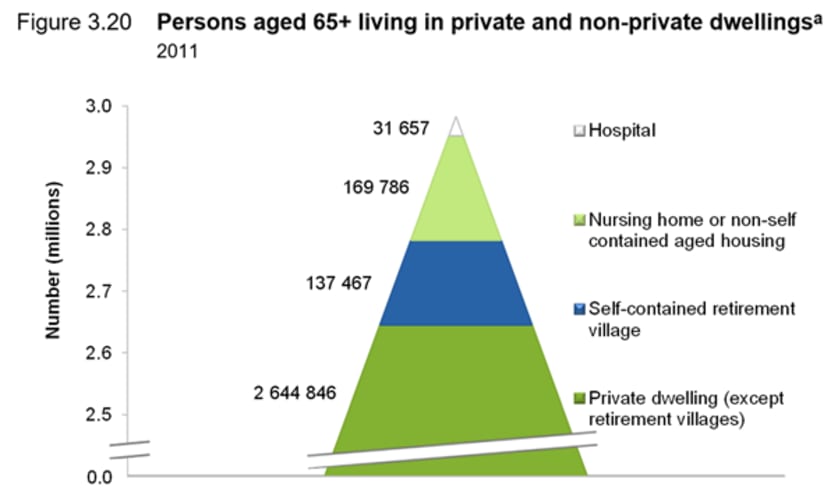

The graph above shows that in 2011, we had 137,467 people living in a retirement village, or 4.6% penetration.

Since 2011, the 65+ population has grown by 41%, from 2.98 million to 4.6 million, an additional 1.21 million people.

For the village sector to maintain 4.6% penetration, it would need to house an additional 56,361 residents, which at an average of 1.3 residents per village home is 43,354 more homes that would have had to be built each year for the past 10 years.

This hasn’t happened. At best 3,500 have been built in good years but less than 3,000 in many years.

Penetration has gone backwards.

And when you think about it, the build rate is only now slowly catching up due to three negative factors. First, the competition for land by both land lease operators on the fringes, and residential developers in the middle rings make it hard to simply get a location to start building.

The second is the capital required from banks. At an average of $400,000 development cost per village home, $1.73 billion of fresh funding is required every year. Are the banks up for this?

The third and most compelling reason is still the lack of understanding by potential customers about what the village value proposition is. The sector has not got the message across to a large enough pool of customers that villages offer independence and control as we age, combined with security and better quality of life. You will live longer and better in a village. Sounds good?

Yet the PwC 2021 Census again shows that the average price increase for village homes nationally is still just 4% compared to residential home values which increased 22% last year alone.

Operators (or their marketing and salespeople) are not comfortable enough to raise prices.

Without price and profit escalation, it’s no wonder banks aren’t keen to fund villages.

In summary, in our view, the sector challenge is a marketing challenge. Operators are not ambitious and demanding. The few operators who set high expectations are seeing 20-25% price increases – and waiting lists – and rebalancing the local penetration rates.

Villages are the proven accommodation solution for older Australians. It’s time to be confident and set 4,335 new homes a year as the minimum growth rate for the sector (plus some).