The operator has recorded a $8.1 million Net Loss after Tax in its Half Yearly results as it looks to write off the value of its bed licences ahead of the end of the Aged Care Approvals Round (ACAR) in July 2024 – but flagged it will expand its business as the sector consolidates over the next few years.

Estia announced a Net Profit After Tax prior of $6.1 million before the amortisation of bed licences saw this figure reduced by a net charge after tax of $14.2 million.

The group plans to write off its licences on a straight-line basis over the period 1 October 2021 to 30 June 2024, which should allow it to declare a $200 million capital loss in FY24 that will be available to offset against future capital gains, the operator added.

The loss comes after Estia recorded only $1 million profit in its FY21 results before a top-up for $21 million in Federal Government COVID-19 funding.

$16K per bed per day

In positive news, the provider’s operating revenue grew to $316.5 million, an increase of 8.7% from the prior corresponding period, while the EBITDA for its mature homes increased to $33.5 million, up from $20.2 million in the same period in 2020.

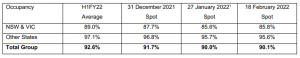

Group occupancy sat at 92.6% during the period – higher than the national average – with net RAD inflows of $23.9 million.

Estia’s average annualised per occupied bed also returned to historic levels at $16,034, or 14.4% of revenue, on the back of the July 2021 increase of $10 a day in the Basic Daily Fee and “sustained operational efficiency”.

Accordingly, shareholders will receive an interim dividend of 2.35 cents per share fully franked.

COVID-19 and workforce shortages see costs rise

However, workforce and COVID-19 costs weighed on the results with staff costs (excluding COVID) increasing 2.9% thanks to higher overtime and agency costs, and regulatory and compliance-related costs growing by 5.3%.

Direct costs related to COVID-19 also rose to $12.1 million – of which, only $7.5 million was elected to be covered by Federal Government grants.

“Ongoing COVID-19 costs will need to be fully covered by funding rates to ensure correction of historic margin erosion is sustained,” its statement to the ASX read.

Plans for acquisitions and new developments

But there was optimism for the future – particularly the opportunities for growth post-COVID and the end of the Aged Care Approvals Round (ACAR) in July 2024.

Estia signalled it plans to look at a number of areas for expansion including:

- Brownfield developments at multiple sites

- Revenue diversification through reablement clinics and a review of home care

- Greenfield acquisitions with 174,000sqm of land in its portfolio, and the opportunity for further land acquisitions in new or existing markets or acquire development sites including “turn-key” homes

The company also expects further consolidation of the sector to enable the growth of its footprint.

“Expected sector exits may deliver opportunities for quality assets on either going concern or asset purchase basis,” it states.

Share buy-back underway

The provider has also completed the first stage of an on-market share buy-back which was announced in November 2021, with 757,000 shares acquired at a cost of $1.6 million – an indication that Estia believes it has been under-valued by the market, and its fortunes are turning.

The buy-back, which will run for up to 12 months, is also aimed at providing more capital for future opportunities, while still providing a return to shareholders.

CEO Ian Thorley said: “I am confident Estia is emerging from this phase of the pandemic as a stronger organisation, well-placed to succeed in a reformed sector and benefit from the favourable demographics of an ageing Australian population and the need for residential care.

“The reforms underway should … lead to a more competitive sector, rewarding high-quality providers with access to capital and quality assets with the opportunity to grow market share, increase occupancy levels and deliver earnings growth.”