Millennials, Gen X’ers and Baby Boomers all would forego cash to see their parents or grandparents better off in later years, a result that arguably puts to bed the political position that increasing client payments for aged care would lose elections.

The 56-page ‘Towards the Tipping Point in Aged Care Funding’ report released by B2B aged care service CompliSpace, out today, surveyed 1,000 people nationally.

Supporting even no inheritance

The results support Plan B, increased co-contribution to deliver the funds to let operators deliver more care minutes plus more than $13 a day in food, to name a few critically needed necessities.

The lead question of the report was:

“Do you support your parents and / or grandparents spending their savings and / or cashing in their assets to enjoy a comfortable retirement, even if it means you receive no inheritance?”

The survey results are sweetly timed one week out from the Federal Budget and as aged care home operators like Wesley Mission throw in the towel, closing three aged care homes in NSW, stating they can no longer sustain or justify losses delivering aged care.

77% say Older Australians should pay for care

Just 23% of those surveyed believed taxpayers should pay for aged care. 77% believe it is the ‘responsibility’ of each of us to fund our care.

51% expect an inheritance: <$250K

51% expect an inheritance: <$250K

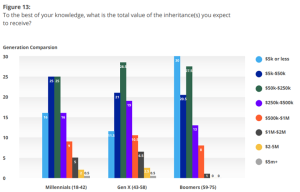

Just on half of respondents believe an inheritance would be coming their way, with most expecting less that $250,000, meaning the decision to support parents or grandparents to eat into that inheritance is a potential big financial sacrifice.

NZ is a model for Plan B

The research adds further weight to Plan B – that older Australians with the means should be allowed to contribute more to the cost of their aged care accommodation and everyday living expenses while those that cannot afford to pay continue to be supported.

This includes the option to access equity in the family home to pay for both residential and home care services – similar to New Zealand where the Government offers interest-free loans which can be repaid from estates and mitigates any need to sell the family home.

The Government’s own 2020 Retirement Income Review found that most older Australians pass away with the bulk of the wealth that they had at retirement intact.

“Co-contributions could enable the sector to improve and expand its services and allow the Government to direct funds towards subsidising the vulnerable older members of the population who are most in need,” the report states.

With just a week until the Federal Budget is revealed, the report is a timely statement that there is a solution to reducing the growing tax burden on younger generations of Australians – and many in the community are in favour.